July 2024 Blog Newsletter

July Captain’s Log

Gratitude!

As we near the end of July, I can’t help but marvel at how quickly time passes and how much we’ve accomplished.

On behalf of all the team members at Anchor Wealth Management, I want to extend a heartfelt thank you. The momentum we’ve built is truly inspiring, with our team conducting an increasing number of client meetings each quarter.

Over the past nearly 20 years, we have been privileged to guide and coach our clients, and our journey continues to gain strength.

I am incredibly appreciative of the many referrals that have come our way.

Your trust in us, not only with the purpose of your money but also in referring your family and friends, has been instrumental in our growth.

This organic growth allows us to continue replicating the types of clients we have enjoyed working with for so many years.

Our firm is growing, and it’s all thanks to you.

The relationships and friendships we’ve built with our clients are the cornerstone of our success. Your continued support propels us forward, and we are excited about the future we are building together.

Thank you for being a part of the Anchor Wealth family.

We are deeply grateful for your trust and support, and we look forward to many more years of shared success and growth!

Celebrate Independence Day by Reaching Your Financial Independence

Independence Day isn’t just about fireworks and barbecues; it’s a celebration of freedom. What better way to honor this day than by taking steps toward your own financial independence? At Anchor Wealth Management, we believe financial freedom is within your reach, and this Independence Day is the perfect time to start your journey.

Set Clear Financial Goals

The first step toward financial independence begins with awareness. Recognizing your finances will help you create a plan to address financial challenges and start to create goals. Set clear, achievable goals that will guide your financial decisions. Whether it’s saving for retirement, buying a home, or starting a business, having awareness empowers you to take control of your financial situation and lay the groundwork for change.

Create a Solid Budget and Track Your Spending

A budget is the foundation of financial freedom. It helps you track your income, manage your expenses, and ensure you’re saving enough for your future. In today’s digital age, most financial transactions are online which means you can track your spending habits more easily. You can discover where your money is going and make necessary adjustments to align with your financial goals.

Reduce and Manage Debt

One way to work toward financial independence is to pay down debt such as car loans, mortgages, and personal loans. High-interest debt can be a significant obstacle to financial flexibility. Focus on paying down debt strategically. As an example, you could start with low balance loans being paid off first to create a feeling of progress and then snowballing payments into the next smallest debt. Consider refinancing options to lower interest rates and make debt more manageable.

Build an Emergency Fund

Financial independence means being prepared for the unexpected. Aim to save at least three to six months’ worth of expenses in an easily accessible account. This safety net will give you peace of mind and protect you from financial setbacks.

Invest Wisely

Investing is a powerful tool for building wealth. Diversify your investments to reduce risk and take advantage of different growth opportunities. Anchor Wealth Management can help you create an investment strategy that fits your goals and risk tolerance.

Plan for Retirement

It’s never too early to start planning for retirement. Contribute to retirement accounts like 401(k)s and IRAs and take advantage of employer matches if available. The earlier you start, the more time your money has to grow to keep you financially independent in retirement.

Financial planning can be complex, but you don’t have to do it alone. A financial advisor can provide personalized advice and help you navigate your journey to financial independence. At Anchor Wealth Management, we’re here to support you every step of the way and there are no prerequisites or income minimums to meet with one of our financial advisors.

Schedule your free consultation today.

By Shane Stuart, Wealth Advisor

Learn More about Shane and the AWM Team

Adam’s Nightstand

I recently finished reading The 6 Types of Working Genius: A Better Way to Understand Your Gifts, Your Frustrations, and Your Team by Patrick Lencioni, published in September 2022. Patrick is probably best known for his book The Five Dysfunctions of a Team.

The 6 Types of Working Genius has been on my reading list ever since I saw Patrick in person at Dave Ramsey’s EntreLeadership conference in Orlando, FL, in 2023. Patrick was one of my favorite speakers at this conference, where he shared new insights about this book and the rationale behind writing it.

This book is designed to help people identify the type of work that brings them joy and energy, while avoiding work that leads to frustration and burnout. It’s a fantastic read for all business leaders to share with their teams. I am eager to apply this knowledge to Anchor Wealth’s team members and highly recommend it to all of you. It’s definitely worth your time!

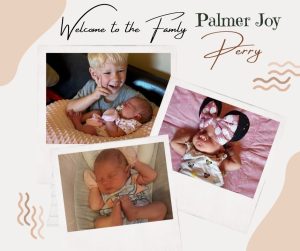

Sugar and spice and everything nice

On July 3rd, at 5:57 PM Palmer Joy joined the Perry family.

Palmer weighed 7 lbs. 14 oz and was 21 inches long.

Chris, Megan, Preston, and Palmer are doing well and settling into a routine at home. Palmer is a great sleeper!

Big brother, Preston, is a huge help and loves taking care of his little sister. He especially likes giving her a bottle.

Bailey, the fur baby, is still unsure about the new addition to the family but she is warming up to her.

Preston gave Palmer her middle name, Joy, after seeing the movie Inside Out 2.

Congratulations to the Perry family…our team can not wait to meet the little princess.