May Captain’s Log

What Is Your Financial Independence Number?

Do you know your Financial Independence Number (FIN)? Recently, I was listening to a podcast, and it was suggested that 99% of people do not know what their FIN is! The FIN is the amount of money someone needs to save to retire and live comfortably off of this lump sum for the rest of their lives. This statistic is alarming and unnecessary. Financial Independence I define as the point at which someone has accumulated enough retirement savings that they do not need to work for a paycheck. If they do choose to work, it is because they enjoy what they do, not because they need the income.

Calculating Your FIN

Here’s a basic example to calculate your FIN number:

Let’s say you make $100,000 per year working in your job.

You expect to receive $40,000 of income from Social Security.

To maintain your $100,000 income in retirement, you need to replace the remaining $60,000 from your retirement savings.

By dividing $60,000 by 4% (a conservative assumption for a withdrawal rate), you would need a retirement “nest egg” of $1,500,000. You would then withdraw $60,000 per year from this $1,500,000. If your investments grew at 8%, your nest egg would continue to grow since you are only drawing 4% per year to supplement your Social Security income.

This example is a basic illustration of how to determine your FIN number. When you work with an advisor from Anchor Wealth, we will consider other variables such as inflation, life expectancy, your financial goals, and desired spending in retirement. Although this example is oversimplified, it is alarming that most Americans do not know their FIN number.

Working with an Advisor

Once you know your FIN number and understand the purpose and goals for your money, you can work with your Anchor Wealth advisor to discern the proper balance of risk versus reward and the necessary rate of return you need to earn on your money to ensure your money lasts throughout retirement.

Inflation and Investment

One potential roadblock to achieving your FIN number is inflation. If inflation is 4% and your investments are not earning at least this rate, you are losing purchasing power. This diminishes the effectiveness of cash alternatives for long-term retirement savings. While a savings account or money market account may be sufficient for emergency funds, they are not ideal for long-term investments. It’s crucial to invest your money to outpace inflation and reach your retirement goals.

Benefits of Professional Guidance

People who manage their money independently may miss out on the accountability and expertise a wealth advisor provides. Advisors help define the purpose and goals for your money and prevent emotional and reactionary financial decisions by staying the course. These professionals have the experience to help you avoid common pitfalls and reach your FIN number more efficiently.

Call Anchor Wealth Today

Call Anchor Wealth to discover your FIN number, or refer a friend who could benefit from discovering their FIN number. Start planning for a financially independent future today.

Adam’s Nightstand

I just finished reading “The Family Board Meeting: You Have 18 Summers to Create Lasting Connection with Your Children” by Jim Sheils.

We all want to connect with our children more deeply and reduce “screen sucking” and device dependence, make each of our children feel important and unique, and build a family legacy of connection and memories!

Katie and I have applied this to our family. I schedule an individual “board meeting” with each of my three kids separately where they each pick the activity. For example, it could be golf, shopping, pickleball, riding bikes, etc. One-on-one quality time with each of my children for roughly about half of the day. The most important part is no cell phones! Dedicated one-on-one time.

I really believe the book offers a great approach and prioritizes the things that matter the most: my family. I trust you will enjoy applying this book with your family.

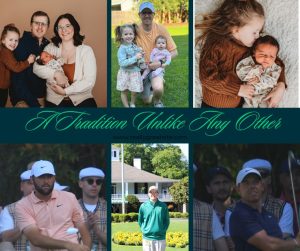

Where In The World Is Shane?

AWM Wealth Advisor, Shane Stuart’s spring has been a perfect blend of family fun and golf excitement!

Hilton Head was a beautiful getaway, especially with Layla rocking her adorable beach baby look.

Finley is finishing up her first year of preschool and already looking forward to next fall. Finley has taken to her role as a big sister with great enthusiasm and loves to help her mom, Tiffany.

Attending the final round of the Masters Tournament at Augusta National is undoubtedly a highlight for any golf enthusiast, and being a PGA member makes Shane one lucky guy! The rest of the team is green with envy that can attend the tournament every year if he wishes.

He parked himself at the 16th hole during the final round on Sunday. He had a fantastic view of the action unfolding on the course.

There is a no-cell phone policy at Augusta. It’s impressive that an eagle-eyed friend of Shane’s spotted him on TV and took a screen shot.

The screenshot featuring this year’s champion, Scottie Scheffler, and Rory McIlroy is a cherished memento.

I am sure that blown up versions of the screen shot’s will find their way to Shane’s office to join his snaps with Tiger Woods.

If you have a chance to visit the office, I’d make it a point to swing by Shane’s office and soak in the golfing glory!