September 2024 Blog Newsletter

September Captain’s Log

The Four Main Areas Clients Value from Advisors

Morningstar recently released a report examining how clients value different capabilities of advisers, drawing insights from four separate studies. The report identified four major themes that reflect what clients seek in their advisors.

The most prominent theme is “advice I can rely on.” Clients value having an advisor with expertise in areas where they lack knowledge, as well as the ability to resolve specific financial needs.

In other words, clients want advisors who are problem solvers and competent in handling their unique financial situations.

Second, clients look for an advisor who can “help me achieve my financial goals.” This involves brainstorming and identifying clear financial objectives, backing them up with a comprehensive financial plan, and ultimately helping clients execute these goals.

Each financial goal should include a target date, and the required amount of money needed to achieve it.

Third, clients seek an advisor who can hold them accountable or “keep them on track” through behavioral coaching. Although clients may not always desire behavioral coaching, they recognize its importance.

Having an advisor who can provide rational, unemotional guidance is key, especially when it comes to investing. This theme emphasizes the critical importance of staying invested, as missing even a few of the stock market’s best days can significantly reduce long-term returns.

Advisors help clients manage the emotions that often come with investing.

Lastly, clients look for advisors who can “maximize my returns,” though this factor received less emphasis than the other three. The studies suggest that clients are more focused on ensuring their goals are met, making this a lower priority.

Clients want advisors who can help them understand the returns they need to achieve their long-term goals and track the progress towards these goals during regular meetings.

In summary, the key points identified by Morningstar’s research align with Anchor Wealth’s ongoing focus.

Clients want advisors who can provide reassurance that they have the knowledge and services needed to offer peace of mind and help them achieve their financial goals.

Working with Anchor Wealth offers clients the confidence that their goals will be met through expert guidance.

As Kids Head Back to College: 2024 Changes to College Savings Options

As most parents of college-bound children just sent their students off for the year ahead, it’s essential to revisit your college savings strategy for your children, particularly with some new changes that took effect in 2024.

Why College Savings Plans Matter

College is a significant financial commitment, and planning ahead is crucial to keep costs from overflowing. College savings plans, like 529 plans, offer tax advantages that can make saving for education more manageable. These plans have traditionally been a key tool for parents aiming to offset the rising costs of tuition, fees, and other educational expenses.

What’s New in 2024?

Expanded Uses for 529 Plans

In 2024, parents can now use these funds to repay up to $10,000 in student loans for the beneficiary and their siblings. This is a significant development, offering families more flexibility in managing education-related debt.

Previously, 529 funds were strictly limited to covering educational expenses like tuition, fees, books, and room and board. The new rule allows you to address student loans, helping to ease the financial burden on recent graduates and their families.

Tax-Free Rollovers to Roth IRAs

Another significant update for 2024 is the ability to roll over unused 529 plan funds into a Roth IRA for the beneficiary. If your child ends up not needing all the funds in their 529 plan, you can now transfer the remaining balance to a Roth IRA without incurring tax penalties. This change allows you to secure your child’s financial future by contributing to their retirement savings, even if their educational path shifts.

This flexibility ensures that your hard-earned savings continue to benefit your child, whether they pursue higher education or choose a different route.

Increased Contribution Limits

To keep pace with inflation and the rising cost of education, the contribution limits for 529 plans have been increased in 2024 as part of the Secure Act 2.0. This allows you to contribute more each year without exceeding the gift tax exclusion limit. The higher limit is particularly beneficial for families who started saving late or those aiming to cover a significant portion of their child’s education costs.

What Should You Do Now?

As your child prepares for the new school year, it’s an ideal time to reassess your college savings plan. Consider talking with your financial advisor about the best strategies from a tax savings standpoint and if you’re contributing the right amount to reach your goals.

Anchor Wealth Management is here to help you understand how the updates impact your savings strategy and guide you in making the best decisions for your family.

By Kirk Pearson, Wealth Advisor

Learn More about Kirk and the AWM Team

Adam’s Nightstand

Not too long ago, I read The “Art of Asking: Ask Better Questions, Get Better Answers” by Terry Fadem. Have you ever struggled to get the information or result you wanted after a conversation? It turns out I was asking the wrong questions.

This book helped me understand the power of asking better questions and the importance of using different types of questions for different purposes. Taking the time to think about the right questions to ask before a meeting will lead to better results and clearer communication.

Another key takeaway from the book is the power of listening! Listening is just as important as asking the right questions. Additionally, preparing the right follow-up questions after the initial one is crucial for getting better results.

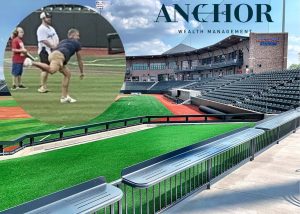

On The Mound

On Wednesday, August 14th Adam Ludwig, Anchor Wealth Management CEO, had the honor of throwing out the first pitch for the Beloit Sky Carp game.

The AWM team was there to cheer him on and we were ready to raz our captain if the pitch just rolled across home plate.

Adam did a great job and showed everyone that he can still bring the heat, throwing a strike right across the plate.

Although it drizzled during the game, everyone had a great time cheering on the Sky Carp despite losing to the Quad City River Bandits 4-3.